Hello there! Did you know something that keeps me up at night? A staggering $1.75 trillion in student loan debt weighs down 43 million borrowers across our country. With college costs averaging $38,270, I’m passionate about helping you take control of your financial future.

Let me share something concerning I’ve noticed in my years of financial expertise – many bright college students struggle with basic money concepts. Only 26% feel somewhat confident about their financial knowledge. My heart aches when I see students falling into cycles of high debt, tough mortgage terms, and growing credit card bills simply because they didn’t have the right financial guidance.

But here’s the good news that makes me excited to share this guide with you! Today’s amazing financial tools make money management simpler than ever before. Whether you’re just starting to track your spending or ready to explore investing, I’ve carefully selected seven powerful platforms that will boost your financial confidence. Together, we’ll explore these fantastic resources designed specifically for college students like you in 2025.

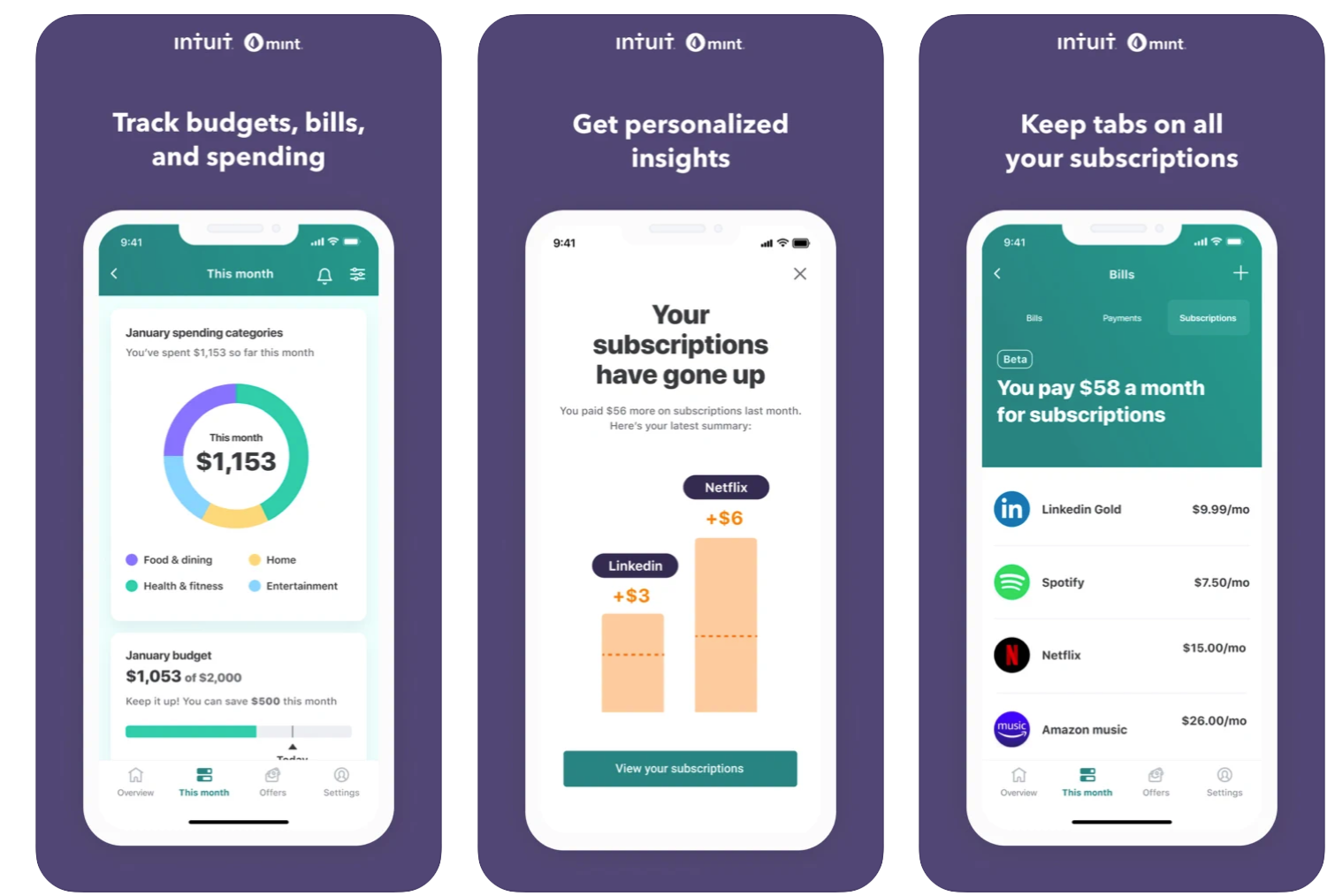

Mint: The All-in-One Financial Management Platform

Image Source: Credello

Let me share one of my favorite money management tools that I regularly recommend to my students. Mint truly stands out as an incredible platform that makes tracking your finances a breeze. I’m amazed by its success – over 5 million downloads [15] tell us just how many students trust this powerful tool!

Mint’s Key Features for Students

Here’s something exciting – Mint connects with more than 17,000 financial institutions [15], giving you a crystal-clear view of your entire financial picture. I love how it automatically sorts your spending into categories, perfect for tracking those textbook purchases, meal plans, and campus activities.

Budget Tracking and Goal Setting

My students often tell me how much they appreciate Mint’s user-friendly budgeting features. You’ll receive helpful alerts when you’re close to your spending limits [15], and the platform even suggests budget amounts based on your past spending. Together, we can set up meaningful financial goals like:

- Saving for that dream spring break

- Building your safety net

- Planning for life after graduation

- Creating your own custom targets [13]

Credit Score Monitoring

Want to build strong credit? I’m thrilled to tell you about Mint’s credit monitoring system. You’ll get free TransUnion VantageScore updates twice monthly [15], plus detailed breakdowns of what affects your score:

- Payment history tracking

- Credit utilization rates

- Account age analysis

- Total number of accounts

- Recent credit inquiries [15]

Mint’s Premium vs Free Features

Here’s my honest take on Mint’s pricing options. While the free version packs plenty of punch, their Premium subscription at $4.99 monthly [13] offers some neat extras.

Free Version Benefits:

- Automatic transaction sorting

- Unlimited budgets

- Basic credit score checks

- Bill tracking tools

- Investment monitoring [15]

Premium Perks:

- Ad-free experience

- Help canceling subscriptions through BillShark

- Advanced data insights

- Spending forecasts

- CSV data exports [16]

For my budget-conscious friends, there’s a middle ground – an ad-free version at just $0.99 monthly [16]. Your security matters too – Mint uses bank-grade encryption and multi-factor authentication [15] to keep your information safe. Plus, you can rest easy knowing the platform prevents unauthorized transfers between accounts [15].

I’m not surprised by Mint’s impressive ratings – 4.7 out of 5 on the App Store (625,000+ ratings) and 4.5 out of 5 on Google Play (180,000+ ratings) [2]. These numbers reflect what I’ve seen firsthand – Mint really does help students succeed in managing their money while focusing on their studies.

Zogo: Gamified Financial Learning App

Image Source: Public Service Credit Union

Ready to make learning about money actually fun? Let me tell you about Zogo, a delightful app that turns financial education into an exciting adventure. What makes my heart sing about this Duke University-backed platform is how it transforms complex money concepts into an engaging game that just clicks with students.

How Zogo Makes Learning Fun

You’ll love how this clever app delivers financial wisdom right to your phone. Through playful challenges and bite-sized lessons, those tricky money concepts suddenly become crystal clear [2]. The magic happens through features like:

- Daily trivia that keeps you coming back for more

- Friendly competition on the leaderboards

- An exciting toolkit to explore

- Achievement badges that celebrate your progress

- Fun avatars to make the experience yours [15]

Here’s something fascinating – the app uses behavioral science to help you retain what you learn. Each quick lesson ends with a mini-quiz, helping those money smarts stick with you [2].

Reward System and Incentives

Want to know the sweetest part? Every bit of learning earns you “pineapples” – Zogo’s fun virtual coins that add up to real rewards [17]. Picture this:

- Trading points for gift cards at your favorite stores

- Supporting causes you care about

- Collecting shiny achievement badges

- Watching your progress soar

- Sharing victories with friends [15]

Students tell me they love how these instant rewards make the journey to financial wisdom so much more exciting. Plus, you’ll earn extra points for bringing friends along on this financial adventure [18]!

Educational Modules Overview

Would you believe there are over 1,100 expert-verified lessons waiting for you [15]? Each tiny 2-minute module follows Jump$tart’s trusted standards [19], covering essential money topics like:

Core Financial Topics:

- Making sense of insurance

- Planning for retirement (it’s never too early!)

- Tackling taxes with confidence

- Smart debt management

- Credit card wisdom

- Home buying basics [18]

The excitement doubles with their new BigFuture partnership, bringing you specialized guides for college money matters. Their scholarship module might just help you unlock more funding opportunities [17].

Every lesson starts with a quick check-in and ends with a knowledge check [2], keeping everything fresh and current [15]. The beauty lies in how Zogo makes complex topics feel like casual conversations with a friend [2]. Plus, many schools can customize the experience just for their students [15].

For our educator friends, detailed progress reports help track how well students are growing their money skills [15]. The proof is in the pudding – over 250 trusted institutions, including big names like US Bank and Chime, have joined the Zogo family [15]. Together, we’re making financial education something students actually look forward to!

iGrad: Personalized Financial Education Platform

Image Source: www.igrad.com

Ready to discover a financial education platform that truly understands you? Let me tell you about iGrad, an incredible tool that’s already helping over 1.2 million students across 500 schools nationwide [2]. What makes my students love this award-winning platform is how it adapts to exactly what you need.

Customized Learning Paths

Here’s something amazing – in just 5 minutes [12], iGrad creates your personal financial roadmap. Using smart technology and clever algorithms [13], the platform builds a learning journey just for you. You’ll receive:

- Daily and monthly money tasks tailored to your goals

- Hand-picked resources that match your needs

- Friendly checkup reminders to keep you on track

- Fresh content that grows with your progress [13]

Student Loan Management Tools

Feeling overwhelmed by student loans? You’re not alone! That’s why I’m excited about iGrad’s loan tracking features. Picture this – in just 5 minutes [14], you can:

- See all your loans in one friendly dashboard

- Play with loan calculators to plan repayment

- Understand your repayment choices

- Make smarter borrowing decisions

- Stay ahead of potential loan issues

Financial Wellness Resources

Beyond the basics, iGrad offers wonderful tools to boost your overall financial health. My students particularly enjoy:

Interactive Learning Components:

- Fun quizzes that reveal your money personality [13]

- Real-time budget tools that actually work

- Helpful calculators for life’s big decisions

- Engaging videos and learning materials

The best part? Everything stays fresh and current [15], helping you master everything from savings basics to making smart choices about cars and homes [15].

University Partnership Benefits

Did you know that over 600 colleges and universities [13] partner with iGrad? This means amazing perks for students like you:

Enhanced Learning Experience:

- Premium features at no cost

- Resources specific to your school

- Custom content for your program

- Lifetime access to keep learning [15]

Want to hear something exciting? When Auburn University teamed up with Regions Bank [13], students gained access to powerful training on:

- Smart budgeting strategies

- Building strong credit

- Growing your savings

- Planning for your future

The platform works closely with financial aid offices, making it easier to understand scholarships, loans, and aid applications [16]. Plus, detailed progress tracking helps identify where you might need extra support [2].

What makes iGrad special is its focus on learning that sticks [2]. You’ll explore money matters through:

- Hands-on online activities

- Dynamic lessons

- Helpful videos

- Community discussions

- Live webinars

With regular updates and new resources [15], you’ll always have the latest tools to build your financial future, from today’s budget to tomorrow’s retirement plans.

Investmate: Investment Education Tool

Image Source: App Store – Apple

Have you ever wished someone would hold your hand through the exciting world of investing? Let me share one of my favorite discoveries – Investmate, a remarkable tool that breaks down stock market basics into bite-sized, 3-minute lessons across 30+ courses [17].

Stock Market Simulation Features

Here’s what excites me most about Investmate – you’ll receive $100,000 in practice money to explore the market without risking your savings [18]. Together, we’ll discover how to:

- Track real-time stock prices and rankings

- Trade ETFs, bonds, and mutual funds

- Use essential research tools

- Monitor your performance

My students love testing different investment strategies and getting immediate feedback on their decisions [19].

Investment Course Library

The heart of Investmate reminds me of my early days learning about investments. The platform offers clear, focused lessons on:

Core Learning Components:

- Building smart strategies

- Reading market signals

- Understanding trading basics

- Managing investment risks

Each lesson appears on clean, simple cards [17]. You’ll find helpful quizzes and a detailed glossary that makes complex terms crystal clear [20].

Real-time Market Analysis Tools

Want to feel like a Wall Street pro? Investmate gives you powerful tools I wish I’d had when starting out:

- Advanced charts showing different timeframes [4]

- Pattern recognition indicators

- Market scanning tools

- Smart alert systems [4]

- Live market data from around the world [4]

These features help us spot potential opportunities using both fundamental and technical analysis [19].

Practice Portfolio Management

Beyond simple trading, I’m impressed by how Investmate teaches complete portfolio management. Let’s explore practical features like:

Portfolio Management Features:

- Smart asset allocation

- Risk assessment tools

- Performance tracking

- Automatic portfolio balancing

Whether you prefer long-term investing or active trading, the platform supports your style [21]. Through regular feedback, you’ll learn to adjust your strategy based on market conditions and your comfort with risk.

The platform uses behavioral science to help you learn better [20], tracking your journey through:

- Achievement milestones

- Skill assessments

- Personal learning paths

- Progress analytics

Worried about security? Your practice trading data stays safe behind robust protection [20]. The platform keeps everything current with regular updates about market conditions and trends [22].

Through partnerships with financial institutions [20], you’ll access:

- Extra learning resources

- Industry knowledge

- Expert guidance

- Market research

What makes me recommend Investmate? Its ability to make complex investment concepts feel approachable without oversimplifying them [22]. Together, we’ll build practical investment skills that prepare you for real-world financial decisions.

CashCourse: Comprehensive Financial Curriculum

Image Source: Mesa Community College

Let me share something special – a financial platform that truly speaks to college students. CashCourse brings together real student insights and university expertise to create an incredible learning experience [5]. My favorite part? The way it breaks down money management into six essential areas: earning, saving, investing, protecting, spending, and education funding.

Interactive Learning Modules

The beauty of CashCourse lies in how it grows with you. Every student’s journey is unique, and the platform understands this perfectly. You’ll find:

Core Educational Components:

- Lessons that adapt to your style

- Engaging quizzes that check your progress

- Your personal learning dashboard

- Progress tracking that keeps you motivated [5]

What makes my heart sing is seeing how this platform connects with over 1,100 colleges nationwide [3]. At John Jay College, students flock to weekly financial literacy classes during community hours – that’s the kind of excitement we love to see [23]!

Budgeting and Planning Tools

The Budget Wizard has become my students’ favorite feature. This clever tool helps you:

- Build spending plans that actually work

- See how your real spending matches your plans

- Tweak your budget as life happens

- Understand where your money goes [24]

“Budgeting Basics” consistently tops the charts as everyone’s favorite course [25]. Plus, the workshop materials make teaching financial skills a breeze [24].

Student Success Stories

The real magic happens when we see how CashCourse transforms students’ financial confidence. Picture this – the University of Indianapolis created a “Financial Literacy Haunted House” that helped students face their money fears [1]!

Here’s what other schools are doing:

Sam Houston State University turned learning into winning with their scholarship contest [1]. Over at Northern Virginia Community College, serving 75,000 students, the platform helps prevent loan defaults [1].

My colleagues at the University of North Texas got creative with their “CashCourse Tour de Money” program, reaching first-year and commuter students in new ways [1]. In Iowa, every freshman starts their college journey with CashCourse’s financial wisdom [6], learning essentials like:

- Smart budgeting techniques

- Money management skills

- Spending strategies that work

- Credit and debt basics

- Financial aid secrets [6]

Want to hear something amazing? Wake Forest University’s “Lunch on Us” program drew 436 students in just one month [26]! One student shared, “CashCourse opened my eyes to long-term planning, especially about 401(k)s” [26].

The platform keeps getting better, with regular updates and new features [3]. Together with CashCourse, we’re building financial confidence that lasts from orientation through graduation and beyond [5].

FinAid: Financial Aid Management System

Image Source: Texas One Stop – University of Texas at Austin

Did you know there’s a trusted friend that’s been helping students unlock financial aid secrets for over 30 years [27]? Let me introduce you to FinAid, my go-to platform that makes securing college funding feel less like solving a puzzle.

Scholarship Search Tools

Here’s something that gets me excited – FinAid connects you with over 4 million scholarships worth more than $22 billion [7]! Through clever search tools, you’ll discover:

Advanced Search Features:

- Awards based on your achievements

- Grants matched to your needs

- Corporate scholarship opportunities

- Aid from your dream schools

My golden rule? Always chase the free money first [7]! The best part? FinAid constantly updates its database with fresh opportunities.

Loan Calculator Features

Wondering how those loan numbers really add up? FinAid’s smart calculators consider everything that matters [8]:

- How your credit score plays in

- What difference a co-signer makes

- Different loan term options

- Interest rate changes

The loan simulator becomes your crystal ball for future payments [28]. You’ll explore:

Simulation Capabilities:

- Ways to lower your payments

- Faster payoff strategies

- Loan combining benefits

- Default prevention tips

- Long-term impact insights

Aid Application Guidance

Remember that intimidating FAFSA form? FinAid makes it feel manageable [29]. You’ll get friendly guidance through:

Application Support:

- Early aid estimates

- Student Aid Index help

- Clear eligibility explanations

- Document checklists

Here’s a tip I always share – your aid eligibility can change yearly, especially when family situations shift or siblings start college [29]. The Student Aid Index calculator helps you plan ahead with solid estimates.

Cost Comparison Tools

Making sense of college costs shouldn’t give you a headache [27]. FinAid’s tools help calculate:

- What each school really costs

- How much to save

- Total aid you’ll need

- Future loan payments

My students love the award letter comparison tool [30]. It helps you:

- Spot the difference between free aid and loans

- Check scholarship requirements

- Figure out true out-of-pocket costs

- See the long-term picture

Want to know what salary you’ll need to handle those loan payments [8]? The calculator shows you exactly that. Right now, undergraduate Direct Loans sit at 6.53%, while PLUS loans are at 9.08% [8].

Your privacy matters – FinAid keeps your sensitive information under lock and key [27]. Through partnerships with schools, you’ll find resources tailored just for you.

What makes me recommend FinAid? It turns complex aid concepts into clear, actionable steps without losing the important details [27]. Together, we’ll make your college funding journey feel less overwhelming.

World of Money: Youth-Focused Financial App

Image Source: World of Money

You know what makes my day? Seeing young people teach other young people about money. That’s exactly what World of Money does through its innovative mobile platform. This remarkable app features financial videos created by youth for their peers [9].

Age-Appropriate Learning Modules

My students often ask me about finding the right starting point for financial education. World of Money solves this beautifully with age-specific learning paths:

- Young Moguls (Ages 7-9)

- Rising Moguls (Ages 10-12)

- Moguls (Ages 13-18)

- Super Moguls (Ages 19-21) [31]

Each day brings new financial wisdom after completing your initial lessons [9]. The platform builds understanding around five key money principles:

Core Financial Principles:

- Building money basics

- Growing your income

- Smart saving strategies

- Investment foundations

- Giving back wisely [9]

Speaking both English and Spanish, the platform opens doors for more learners [32]. Together, we’ll explore everything from basic money concepts to entrepreneurship essentials [33].

Parent-Student Integration

Something I’ve learned over my years of teaching – family support makes all the difference in financial learning. World of Money brings families together through:

- Virtual “Money Matters” family forums

- Parent-controlled settings

- Instant spending alerts

- Shared learning activities [32]

Parents become financial coaches with tools to:

- Watch spending habits

- Create money goals

- Set smart limits

- Follow learning progress [34]

Progress Tracking Features

The results speak for themselves. Check out these impressive numbers:

Performance Metrics:

- Students show 47% better financial understanding [10]

- 83% master key money concepts [10]

- Weekly quizzes keep knowledge fresh

- Clear goal tracking

Weekly financial quizzes make learning stick [10]. Here’s something remarkable – 91% of families prefer this approach over traditional classroom learning [10].

The platform celebrates your journey with:

- Special achievement moments

- Progress celebrations

- Performance insights

- Skill growth tracking

Through partnerships with Kahoot! and Million Bazillion [11], students unlock even more learning adventures.

For our educator friends, World of Money provides:

- Quick tech help

- Teacher training

- Helpful teaching guides

- Clear learning paths [32]

What touches my heart about World of Money is how it makes financial education feel natural and relatable through youth-led content [9]. This matters deeply, especially when we know 3 out of 4 teens don’t feel confident about money matters [11].

Comparison Table

Looking for the perfect financial tool for your needs? I’ve spent years helping students find their ideal match, and I’m excited to break down these amazing platforms for you. Let’s explore how each one could fit into your financial journey.

| Tool Name | Primary Features | Cost/Pricing | Key Educational Components | Target Users/Focus | Notable Statistics/Reach |

|---|---|---|---|---|---|

| Mint | Budget tracking, credit monitoring, goal setting | Free version; Premium $4.99/month; Ad-free $0.99/month | Transaction categorization, budget creation, credit score monitoring | College students managing daily finances | 5M+ downloads; 17,000+ financial institutions connected |

| Zogo | Gamified learning, interactive challenges, reward system | Not mentioned | 1,100+ educational modules, daily trivia, achievement system | Young adults learning financial basics | Partnerships with 250+ institutions including US Bank |

| iGrad | Personalized learning paths, loan management | Free through participating institutions | Behavior assessment, budgeting tools, loan calculators | College students seeking comprehensive financial education | 1.2M+ students across 500 schools |

| Investmate | Stock market simulation, real-time analysis | Not mentioned | 30+ courses, 3-minute lessons, virtual trading ($100K practice funds) | Students learning investment basics | Not mentioned |

| CashCourse | Interactive modules, Budget Wizard tool | Free | Six main learning areas: earning, saving, investing, protecting, spending, education funding | College students seeking comprehensive curriculum | 1,100+ partner colleges and universities |

| FinAid | Scholarship search, loan calculators, aid application guidance | Free | FAFSA guidance, cost comparison tools, loan payment calculators | Students seeking financial aid management | 4M+ scholarships worth $22B+ in database |

| World of Money | Age-appropriate modules, parent-student integration | Not mentioned | Five core principles: learning, earning, saving, investing, donating | Youth aged 7-21 | 47% financial aptitude improvement; 91% family preference rate |

My students often ask which tool they should start with. The answer depends on your specific needs. Are you focused on daily budgeting? Mint might be your best friend. Struggling with financial aid forms? FinAid could be your guiding light. Want to learn through games? Zogo speaks your language.

Remember, you don’t have to stick to just one tool. Many of my successful students combine different platforms to create their perfect financial toolkit. The best part? Most of these resources are either free or available through your school. Together, we’ll find the right combination that works for you!

Conclusion

You know what makes my heart sing? Seeing how far financial education tools have come! As someone who’s spent years helping students master their money, I’m thrilled to share these seven incredible platforms with you. From Mint’s smart budget tracking to World of Money’s age-perfect lessons, each one brings something special to your financial journey.

Let me tell you what excites me most – how each tool tackles different money challenges you might face. Need help tracking daily spending? Mint becomes your trusted companion. Want to make financial learning fun? Zogo turns it into an adventure! Looking for personalized guidance? iGrad adapts to your unique path. Ready to try investing? Investmate lets you practice without risking real money. CashCourse structures your learning journey, FinAid makes aid applications less daunting, and World of Money grows with you at every age.

Here’s something wonderful – most of these platforms come free through your school. That’s right! Quality financial education shouldn’t depend on your bank account. What makes me particularly proud is how these tools blend real-world practice with essential knowledge, helping you build money habits that last.

Remember this – becoming money-smart doesn’t mean you need to become a financial wizard overnight. Through regular practice with these tools, you’ll develop skills that serve you well beyond your college years.

My advice? Pick the tools that speak to your current needs and financial dreams. Start small, stay consistent, and watch your financial confidence grow. Together, we’re not just managing money – we’re building your pathway to financial success. I’m here cheering you on every step of the way!

References

[1] – https://www.pcmag.com/reviews/mintcom

[2] – https://mint.intuit.com/

[3] – https://crm.org/news/intuit-mint-review

[4] – https://www.econedlink.org/wp-content/uploads/2020/09/Student-Activities_-Analyzing-a-Credit-Report-and-Score.pdf

[5] – https://moneywise.com/managing-money/budgeting/mint-com

[6] – https://www.barchart.com/story/news/18109546/is-mints-premium-subscription-worth-it

[7] – https://www.cnbc.com/select/mint-budgeting-app-review/

[8] – https://zogo.com/

[9] – https://zogo.com/mobile-app

[10] – https://www.honorcu.com/blog/you-can-learn-earn-rewards-with-zogo-financial-literacy-app/

[11] – https://www.clearmountain.bank/community/community-engagement/zogo

[12] – https://zogo.com/educators

[13] – https://newsroom.collegeboard.org/zogo-partners-bigfuture-empower-next-generation-financial-literacy

[14] – https://igradfinancialwellness.com/about-us/

[15] – https://www.igrad.com/

[16] – https://ocm.auburn.edu/newsroom/news_articles/2022/04/051330-igrad-financial-wellness.php

[17] – http://www.igrad.com/FinancialLiteracyForCollegeStudents/

[18] – https://sfs.columbia.edu/content/igrad

[19] – https://www.stern.nyu.edu/portal-partners/financial-aid/tools-resources/igrad

[20] – https://capital.com/learn-trading-app

[21] – https://www.howthemarketworks.com/

[22] – https://virtualstockmarket.tdbank.com/

[23] – https://apps.apple.com/us/app/investmate-learn-to-trade/id1229995329

[24] – https://www.prorealtime.com/en/

[25] – https://www.investor.gov/introduction-investing/general-resources/news-alerts/alerts-bulletins/investor-bulletins/investor-bulletin-top-10-investment-tips-college-students

[26] – https://play.google.com/store/apps/details?id=com.capital.investmate&hl=en_US

[27] – https://www.cashcourse.org/info/About

[28] – https://www.cashcourse.org/info

[29] – https://www.cashcourse.org/info/Community/Success-Stories/John-Jay-College

[30] – https://www.cashcourse.org/info/News/-How-to-Use-CashCourses-Revamped-Budget-Wizard

[31] – https://www.cashcourse.org/info/News/Students-and-Teachers-Agree-Our-Most-Popular-Resources

[32] – https://www.cashcourse.org/info/Community/Success-Stories

[33] – https://www.nefe.org/news/nefe-digest/2019-spring/success-stories-iowa-cashcourse.aspx

[34] – https://www.cashcourse.org/info/Community/Success-Stories/Wake-Forest-University

[35] – https://finaid.org/

[36] – https://www.collegecovered.com/award-letter-tool/

[37] – https://finaid.org/calculators/loanpayments/

[38] – https://studentaid.gov/loan-simulator

[39] – https://finaid.org/financial-aid-applications/

[40] – https://www.nasfaa.org/award_notification_comparison_worksheet

[41] – https://www.masteryourcardusa.org/resource/world-of-money-developing-financially-responsible-adults-one-child-at-a-time/

[42] – https://www.worldofmoney.org/

[43] – https://www.worldofmoney.org/the-institute/

[44] – https://www.worldofmoney.org/empowering-black-youth-and-families-through-financial-education-need/

[45] – https://pennian.bank/blog/financial-apps-for-kids-and-teens/

[46] – https://goalsetter.co/

[47] – https://greenlight.com/financial-literacy-for-kids-and-teens